Most important strategic risks and opportunities for Stedin Group in 2021

This section contains an overview of our most important risks and opportunities and a description of our top 5 risks. For information about our financial reporting risks, see the sections on Judgements, estimates and assumptions For information on the risks related to the financial instruments, see the section on Management of financial risks in the Financial Statements. For further information on the process related to strategic risks, see the section on Risk management.

Connection of risks to strategic spearheads and material topics

Strategic spearheads | Change | |||||

|---|---|---|---|---|---|---|

Risk | Category | Material topics |

|

|

| |

1Cyberattack causing damage to society and business operations | Operational | Supply security – Smart grids, data technology – Safety and security | ● | ● | ● | |

2Increasing pressure on our long-term ability to retain the ‘A’ credit rating issued by S&P | Financial | Investments in our grids – Financial, economic performance – Affordable and efficient services | ● | ● | ||

3 Increased likelihood of surge to replace obsolete assets | Strategic | Supply security – Investments in our grids – Financial, economic performance | ● | ● | ● | |

4 Unavailability of enough people with the required competencies | Operational | Investments in our grids – Good employment practice | ● | ● | ||

5Insufficient connection and transmission capacity | Strategic | Customer satisfaction – Stakeholder dialogue and environment – Investments in our grids | ● | ● | ||

6 IT/OT landscape insufficiently prepared for the future | Strategic | Smart grids, data technology and innovation | ● | ● | ||

7 Uncertainty about implications of changing E&G laws and other regulations (NL and/or EU) | Compliance | Stakeholder dialogue and environment – Investments in our grids | ● | |||

8Availability and quality of data insufficient | Operational | Smart grids, data technology and innovation | ● | |||

9Services on core tasks insufficiently compliant | Operational | Customer satisfaction – Supply security | ● | |||

10Gas investments difficult | Strategic | Financial, economic performance – Affordable and efficient services | ● | |||

11High activity in outdoor space and below ground | Operational | Investments in our grids | ● | |||

12Excessive environmental footprint | Strategic | Positive impact on people and planet | ● | |||

13Focus on cultural values and conduct insufficiently effective | Strategic | Good employment practice | ● | |||

14Large-scale product recall | Operational | Positive impact on people and planet – Supply security | ● | ● | ||

15Impact of accidents related to Stedin Group | Safety | Safety and security | ● | |||

16Environmental pollution of surroundings | Compliance | Positive impact on people and planet | ● | |||

17Uncertainty about the duration of availability of the communication network | Operational | Smart grids, data technology and innovation | ● | |||

18Shortages of materials | Operational | Investments in our grids | ● | |||

+ New in 2021 / = Equal to 2020 / ↑ Increased relative to 2020 / ↓ Decreased relative to 2020

Connection of opportunities to strategic spearheads and material topics

Strategic spearheads | Developments | ||||

|---|---|---|---|---|---|

Opportunity | Material topics |

|

|

| |

1Strategic supplier relationships | Stakeholder dialogue and environment – Positive impact on people and planet | ● | |||

2Development and deployment of disruptive technologies and methods | Smart grids, data technology and innovation | ● | |||

3Rates structure of the future | Financial, economic performance – Affordable and efficient services | ● | ● | ||

4Application of new energy carriers | Investments in our grids – Smart grids, data technology and innovation | ● | |||

5Increase predictability of investments through improved prediction of customer demand* | Investments in our grids – Stakeholder dialogue and environment | ● | |||

6Position Stedin as an essential link in the energy transition | Stakeholder dialogue and environment – Smart grids, data technology and innovation | ● | |||

7Make comprehensive assessment in relation to investments between electricity, gas or future energy sources | Investments in our grids – Smart grids, data technology and innovation | ● | |||

8Future-proof grid management based on data-driven predictions and decision-making | Smart grids, data technology and innovation – Supply security | ● | |||

9Increased effectiveness and efficiency through supply chain-focused operations | Affordable and efficient services – Financial, economic performance | ● | ● | ||

10Lower societal costs through collaboration with partners in coverage area | Affordable and efficient services – Financial, economic performance | ● | ● | ||

- * This is a continuation of the opportunity ‘Facilitate stakeholders and customers and provide them with more self-services’.

The above table includes all the ‘Strategic risks and opportunities’ identified by us in 2021.

Categories of strategic risks and opportunities

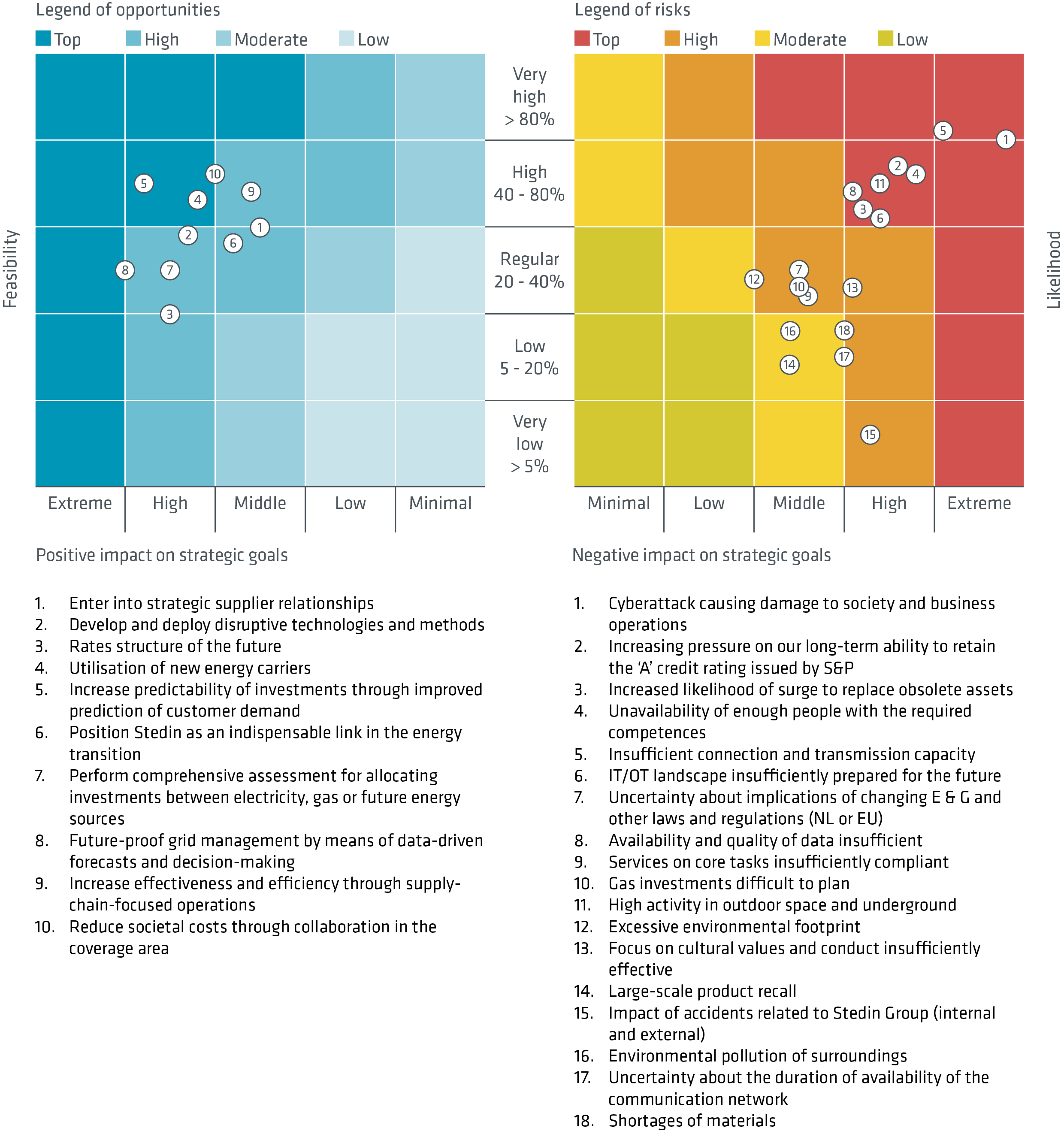

Stedin Group assigns its strategic risks and opportunities to five categories, from low to top. In evaluating risks and opportunities, we compare the likelihood of their occurrence with their potential impact on the achievement of our three strategic spearheads. This comparison led to the risk matrix below for 2021.

Information on top 5 risks: Core & More

In 2021, it was decided to adopt a different format for explaining the most important risks and opportunities. Stedin Group is increasingly confronted with the limitations affecting the engineerability of the energy transition. This complexity manifests itself in various areas. We have therefore decided to provide a more detailed explanation in 2021 of the five most important risks related to this engineerability.

Risks

Title of risk: | 1 Cyberattack causing damage to society and business operations |

|---|---|

Risk tolerance | Avoiding |

Risk assessment | Top |

Description: As a result of its strategic location as well as its social and economic importance, the Stedin Group infrastructure is an attractive target for cyberattacks. The chance of a cyberattack is progressively increasing as a result of technological developments and the increasing dependency on digitalisation. A cyberattack can have major consequences for the services of Stedin Group and its stakeholders. This can endanger vital infrastructure and hence the stability of the energy network. | |

Causes: State-sponsored actors: well funded and organised, whether or not directly related to foreign powers, whose actions are inspired by political motives. - Activist hackers (including terrorist organisations): actions are inspired by political, social or other activist motives. Driven by their ideological motives, they carry out targeted attacks on Stedin due to its social relevance. - Organised crime: actions are driven by economic motives, employing ransomware or other means. Focus on personal data or improper financial transactions. - Employees and suppliers: often able to access the internal network by virtue of their work. From this position, they can cause damage, intentionally or unintentionally.- Script kiddies: using a code published online to carry out attacks of a non-advanced nature. Competition between actors and particular interest in the topic of security play an important role in this regard. | |

How did we respond to this fact: We are working on integral security that connects the related areas of expertise. Stedin applies internationally recognised standards in order to reduce its vulnerabilities to outside threats, with a focus on prevention, timely detection and the resulting actions. As Stedin bases its cybersecurity on the tried and tested Deming cycle for continuous quality improvement, we arrange to be regularly tested by external specialised parties in relation to the ISO27001 standard. Within Netbeheer Nederland, we make a constructive contribution to the formulation of a European Network Code In addition, we work closely with other organisations in the private and public sector in the field of cybersecurity. At the European level, we do this through the European Network for Cyber Security (ENCS) with other grid managers in other countries. At the national level, we work with the Cyber Security Council, the Vital Infrastructure Committee of VNO/NCW, industry association Netbeheer Nederland and the National Cyber Security Centre, among others. We share information with these organisations on threats and measures, and we also collaborate with them to develop standards and provide mutual support in case of an actual threat. Exercises, such as the largest Dutch cyber-crisis exercise ISIDOOR, are a key element in this regard. You can read more about the impact of this risk in the section on 'Safety and security'. | |

Title of risk: | 2Increasing pressure on our long-term ability to retain the ‘A’ category credit rating issued by S&P |

|---|---|

Risk tolerance | Avoiding |

Risk assessment | Top |

Description: Facilitating the energy transition and enabling the rapidly growing (digital) economy are pushing up Stedin Group’s levels of investment. The present regulatory model is not sufficiently aligned with the financial challenges accompanying this growth: It provides for compensation for the costs incurred, including a reasonable return. However, Stedin Group receives this compensation over an extended period, while the investments need to be made now. Our credit rating comes under increased pressure due to the difference in outgoing and incoming cash flows. While this pressure was partly alleviated by a capital injection from the shareholders of Stedin Group in 2021, more equity will need to be raised in the coming years to strengthen our balance sheet. | |

Strengthening our equity capital base: In 2021, our equity capital base was strengthened through an equity injection of €200 million. It was decided to issue preference shares. Existing shareholders subscribed to this issue. As part of the strengthening exercise, we also made agreements with the shareholders on follow-on arrangements, which we are currently discussing. A review of our long-term financing strategy was also commenced (until mid-2029). This involves us exploring the broad scope of possibilities in governance and shareholder structure for further strengthening our financial position. | |

Title of risk: | 3Increased likelihood of surge to replace obsolete assets |

|---|---|

Risk tolerance | Neutral |

Risk assessment | Top |

Description: As a result of the current replacement policy, the average age of our assets is increasing. This gives rise to the risk that grid performance will deteriorate in the future. The risk of a surge of replacements increases if the current policy were to be continued. In view of the potential number of these assets needing to be replaced, it will not be possible in practice to scale down these replacements quickly. This will then result in increased failures and disruptions, which will have an adverse impact on our customers and stakeholders while also leading to high repair costs. | |

Causes: Age composition of grid – Restrained replacement policy and due to the loss of support from suppliers – Limited quality of available information. | |

Consequences: Possible surge of replacements – Larger scale quality investment – Greater challenge to undertake, and complete, this work (technical staff and financing) | |

How did we respond to this fact: Condition and risk analysis: Each year, we carry out a condition analysis of Stedin’s assets. This condition and related risk analysis provides input for the Strategic Investment Plan: the potential surge of replacements is identified in this multi-year investment plan. We track the developments over time, and the risks are partly mitigated, due to our implementation in recent years of data-driven maintenance and replacement via advanced analytics. We therefore expect that developments related to risk for the grids will decrease. Having implemented these measures across a reasonably broad front for our asset base, we can observe that this mitigation is insufficient to prevent obsolescence in our grids. In addition to framing multi-year plans for replacing the assets, various initiatives have been launched within our change programmes System Operator and Sustainable Energy Transition aimed at achieving better management of this risk. The availability and quality of the necessary data remain crucial. Furthermore, we are currently working to establish the most cost-effective measures for preventing increasing grid obsolescence. | |

Title of risk: | 4Unavailability of enough people with the required competencies |

|---|---|

Risk tolerance | Avoiding |

Risk assessment | Top |

Description: Due to ageing and tightness in the labour market, there is a risk that we will in the longer term no longer have enough staff with the required technical and other competencies to achieve our strategic objectives. | |

Consequences: Stedin is unable to sufficiently perform its core tasks, resulting in: a deterioration in the quality and efficiency of service provision, an inability to fulfil our role in facilitating the energy transition and decreased employee satisfaction. | |

Strategic personnel planning: The Strategic Personnel Plan provides insight into and an overview of current and future roles and necessary staffing numbers. While this does not overcome the shortage, it does provide us with a roadmap clearly setting out where we need to train or recruit now in order to minimise the shortage in the future. | |

Title of risk: | 5Insufficient connection and transmission capacity |

|---|---|

Risk tolerance | Neutral |

Risk assessment | Top |

Description: The expansion of our electricity grids is planned on the basis of the prediction of customer demand. Timely reinforcement of our grids may not be possible if customer demand evolves significantly faster than expected or if execution takes significantly longer than planned. In that situation, we can offer our customers a connection but not the necessary transmission capacity. As a result, we are unable to meet the customers' requirements. The customer must then modify, defer or cancel the planned project. The achievement of climate targets is also delayed if congestion management is not possible. If congestion management is possible, some of the customers can then be connected, provided that congestion management is applied in the case of the area affected by congestion. It is expected that applying congestion management will entail costs. | |

Causes: Long lead times of licensing and planning procedures for spatial integration, amongst other things, mean that lead times for grid reinforcements are far longer than the lead times of our customers’ projects. - There is significantly increased demand due to SDE subsidies, under the Sustainable Energy Generation Incentive scheme (since 2016), as well as rapid growth in the number of connections for wind, solar farms, rooftop solar and electric charging points. - The grid configuration in rural areas does not provide for large generation volumes. - Limited engineerability due to constrained scope for investment and labour market shortages. - Congestion affecting TenneT. | |

Consequences: Unable to deliver in a timely manner according to customers’ requirements. - The customer has to modify, defer or cancel the planned project. Realisation of energy transition delayed. - Reputational damage in respect of grid manager’s core task. - Claims filed by developers and others. - Costs of temporary solutions (market-based flexibility/congestion management). | |

Flexibility for managing supply and demand: Encourage deployment of flexibility for managing supply and demand, enabling us to make more efficient use of grid capacity. In 2021, we called up flexibility on several occasions in the Zuidplaspolder, where commercial growers use their CHP installation to help keep the grid load within the permitted limits. - Improved system efficiency: Encourage improved system efficiency. This enables us to make better use of grid capacity by linking local energy generation and use to smart choices of location as well as cable pooling, whereby solar and wind-generated energy is combined, or pooled, on a single cable to increase the capacity utilisation of a connection.- Active lobbying for expanding connection possibilities: We actively lobby to create grid capacity for other types of connections. In 2021, we finalised the implementation of amendments to the Electricity Act. These amendments concern the prohibition of multiple connections for solar farms, cable pooling and supplements to the standard connection methods. In addition to facilitating the connection of more sustainably generated energy, these measures also enable us to make better use of existing grid capacity, amongst other things. The amendments were partly the result of lobbying by the grid managers. - Insight into grid capacity: Maps are published on the Stedin website showing the current grid capacity for power generation as well as consumption. The information this provides on possible restrictions in available grid capacity is useful to business customers in a planning context. For the Regional Energy Strategies (RES), we provide insight into the available grid capacity, including planned grid reinforcements. We have developed opportunity maps to show where new initiatives are most likely to succeed when implemented in a planning horizon up to 2020. This provides public authorities with greater clarity regarding the feasibility of their RES ambitions up to 2020. Stedin will continue to invest in the coming years in making available and planned grid capacity transparent to support the market in general and that of national and regional programmes in the energy transition in particular. - Spatial integration of grid infrastructure: We use master plans to make clear to municipalities and provinces where new infrastructure is needed. In that way, we aim to shorten the lead times for issuing permits, to speed up the availability of new infrastructure. | |