Financial, economic performance

Stedin Group has a public task. We treat our social capital prudently and intelligently. A financially healthy Stedin Group has the necessary strength to facilitate the energy transition.

The conversion of the energy system is a condition for achieving the climate targets that have been set and for facilitating a climate-neutral economy by 2050. In the spring of 2021, PwC calculated that the three major regional grid managers (Liander, Stedin and Enexis Netbeheer) and the manager of the national high-voltage grid (TenneT) will need to invest at least €102 billion in the electricity grid and the regional gas grids by 2050. It is becoming increasingly apparent that it will only be possible to secure the financing if all the parties work together, from regulators to public authorities. Close consultation with a large number of stakeholders was therefore a recurrent feature of 2021. The two round-table meetings that were held with representatives of the grid managers, VNG/IPO, the Netherlands Authority for Consumers and Markets (ACM) and the Ministry of Economic Affairs and Climate Policy are an example of this. While these meetings produced several positive results, much still needs to be done to secure the necessary financing up to 2030 in any event.

Increasing investments

Stedin's total investments in the energy transition in the period from 2021 up to and including 2030 are expected to total over €8 billion. That is almost €2 billion more than previously estimated for this period. At the same time, the developments in relation to Fit for 55 as well as around congestion are not yet included in these figures. As soon as it is clear how the plans are to be implemented, the assessment of the financial implications will be updated and the investment agenda will increase further. The investments by Stedin in the energy network are necessary to keep the grid safe and reliable, to achieve the climate objectives, to fulfil the ambitions in the Regional Energy Strategies as well as to facilitate economic growth. The necessary funds will come partly from our own earnings and partly from loans that we raise. Additional equity will also be needed.

Capital requirement

Further to the €200 million in equity capital that has already been paid up, Stedin expects to need an additional €800 million at a minimum. This is the minimum amount needed to continue to meet our core tasks and maintain an ‘A’ category credit rating. Otherwise investments need to be further deferred, and there is no financial buffer. In the desirable situation, Stedin has sufficient financial means to enable it to provide maximum facilitation of the energy transition and economic growth as well as to ensure management and maintenance to be at the appropriate risk level into the future. In this scenario, Stedin expects to need at least €1.8 billion to guarantee a safe and reliable grid for future generations as well. In light of its responsibility, Stedin is targeting this desirable scenario.

ACM method decision

A key element in relation to financing is the new method decision established by the ACM, which was published in September 2021. This decision determines how the tariffs that grid managers are allowed to charge are structured until the end of 2026. For grid managers, it is essential that this enables sufficient funds to be generated for them to (pre)finance the energy transition. As costs precede revenues for the grid managers when undertaking investments, this presents a financing challenge. The grid managers urged that the current regulatory model should be adjusted, since at this moment it is not sufficiently in line with the tasks facing the grid managers in facilitating the energy transition. This resulted, among other things, in the ACM no longer pushing back part of the ‘reasonable revenues’ of the grid managers. As a consequence, the need for (pre)financing is reduced. However, that is still not sufficient to cover the sharply rising costs for the electricity grid.

And-and strategy

Alongside appropriate regulations, the only way to generate sufficient financial resources is to adopt an ‘and-and strategy’. That means continuously improving the efficiency of our own organisation, lobbying for regulatory improvements and also asking current and potential new shareholders to make a contribution. Progress was made on all fronts in 2021.

Working effectively and efficiently

In 2018, a five-year efficiency programme was launched with the aim of structurally reducing our expenditure. You can read more about the objectives and results of this efficiency programme in the section on Affordable and efficient services.

Long-term financing

Stedin has reached out to its shareholders. In 2021, to cover the short-term requirement, shareholders made a capital contribution of €200 million to strengthen Stedin’s equity, after a large part the profit of €251 million related to the 2019 disposal of Joulz Diensten has been retained within the company. Municipalities with shares in Stedin were able to individually subscribe to the issue of cumulative preference shares. During the meeting of shareholders on 25 June, the shareholders approved the capital contribution. 80% of the shareholders subscribed to the preference shares. By doing so, they have enabled us to take a major next step towards a financially healthy future for Stedin Group, supporting the progress of the energy transition in our region. In accordance with the agreements that were made relating to the contribution of €200 million, in the second half of 2021, Stedin and its shareholders again started discussions on how the long-term capital requirement can be met.

Exploring possibilities for attracting new shareholders

Financing the energy transition places demands on us as a grid manager, on our shareholders and also on other parties including the central government. In 2021, the Ministry of Economic Affairs and Climate Policy and the Ministry of Finance noted that, in addition to the Method Decision, an adjustment is needed to finance the conversion of the energy system. Stedin, Alliander and Enexis are jointly engaged in talks with the two ministries and are involving their shareholders in this process. We are also exploring the possibilities of attracting other new shareholders. Stedin sees a strategic interest in attracting new shareholders, municipalities and provinces, since we, as public bodies, need to act in partnership to achieve the energy transition in the period until 2050.

Equity

In March, Stedin Group successfully refinanced a perpetual subordinated hybrid bond loan of €500 million. The bond loan has a coupon rate of 1.500% and can be redeemed early in March 2027. The issue of the bond loan enabled Stedin to redeem the current hybrid bond loan with a coupon rate of 3.25%. This hybrid refinancing will reduce Stedin's capital costs. The proceeds will be used for general business purposes, with an emphasis on the energy transition.

Debt – Stedin Group issues green bond

In November, Stedin Group successfully issued a green bond for the second time. The €500 million raised is linked to investments made by Stedin Group in sustainable projects, such as connecting new wind turbines and solar farms to Stedin’s electricity grid and energy-efficient housing. The loan of €500 million has a term of five years, an issue price of 99.666% and a coupon interest of 0.0%. Stedin Group attracted existing and new sustainable investors through the bond issue. The issue was oversubscribed four times. This is partly attributable to the excellent terms under which the bond was issued. The bond is listed on Euronext Amsterdam. More information on the Green Finance Framework and the Green Bond Reports is available on our website.

The issue of the green bond was undertaken in line with the latest legislation and regulations and was also based on an update of our Green Finance Framework. This update enables Stedin to continue issuing green debt securities into the future. The framework was assessed by ISS ESG as an independent expert. In addition, ISS ESG gave Stedin a B corporate sustainability rating, putting Stedin amongst the top 10 companies in its sector.

Stedin issued a green bond for the first time in 2019. The section on 'Impact on people and planet' gives various examples of the green investments we have been able to undertake using the funds raised through this bond.

Credit rating

Standard & Poor's (S&P) reaffirmed Stedin Group’s A- credit rating with a stable outlook. In their report, S&P state that they now project that Stedin will have no headroom under the current credit rating in 2021-2023. Lower returns coupled with incremental capex will result in persistently negative cash flows, subsequently putting pressure on Stedin's financial ratios. S&P nonetheless notes that Stedin is firmly committed to an unchanged financial policy. The equity injection of €200 million shows that shareholders are supportive of this policy. In talks, S&P has noted the ongoing absence of formal, public confirmation in this regard. S&P believes that Stedin will require additional measures to strengthen its financial position in the coming period, for example through raising more equity from new or existing shareholders. They state that they will keep a close eye on developments and closely monitor progress in the coming period.

EU Taxonomy

The EU Taxonomy is part of the European Union’s Green Deal, which aims to see Europe becoming a climate-neutral continent by 2050. The Taxonomy is a guide for investments in sustainability and makes clear which of our activities may be classified as sustainable and contribute to preventing climate change or to mitigate its consequences (climate change adaptation). In 2021, Stedin complied with the first reporting obligations. As a public-interest company, we are obliged to report on the sustainable proportion of our turnover, capital expenditure (CapEx) and the proportion of operating expenses (OpEx) for the 2021 financial year in alignment with the EU Taxonomy.

Based on the NACE codes (the EU classification of economic activities), sustainable economic activities are made transparent. They constitute the ‘taxonomy-eligible’ economic activities. Stedin’s main activities fall under NACE codes ‘35.13 Distribution of electricity’ and ‘36.0 Water collection, treatment and supply’. Non-sustainable economic activities are part of the ‘taxonomy of non-eligible’ economic activities. This includes NACE code '35.22 Distribution of gaseous fuels through mains’. A different view may possibly emerge in the future regarding these activities, impacting the level of Stedin’s eligible economic activities. We report on the non-sustainable economic activities and related revenue streams, capital expenditure and operating expenses in accordance with the EU Taxonomy rules applicable to 2021 in our annual report.

Economic activities | NACE | Absolute turnover | Proportion of turnover | Absolute | Proportion of | Absolute | Proportion of |

|---|---|---|---|---|---|---|---|

(x €1 million) | |||||||

Taxonomy-eligible activities | |||||||

Transmission and distribution of electricity | 35.13 | €866 | 68% | €422 | 61% | €52 | 62% |

Water collection, treatment and supply | 36.0 | €26 | 2% | €0 | 0% | €4 | 4% |

Total eligible activities | €892 | 70% | €422 | 61% | €56 | 66% | |

Taxonomy non-eligible activities | |||||||

Taxonomy non-eligible activities | €387 | 30% | €265 | 39% | €28 | 34% | |

Total | €1,279 | 100% | €687 | 100% | €84 | 100% | |

Total turnover under the EU Taxonomy is consistent with IFRS reporting standards and hence is equal to the total turnover included in the financial statements. The turnover under NACE code 35.13 includes revenues recognised for electricity transmission and connection services, metering services and other services, such as the lease, installation and management of electrical plant and systems. The operating expenses stated under NACE code 35.13 include expenditure for maintenance of and clearance of failures affecting assets for the purpose of maintenance of our electricity grid. The capital expenditure under 35.13 consists of all the investments in property, plant and equipment related to our electricity grid. The capital expenditure under NACE code 36.0 consists of property, plant and equipment for the pipelines and installations of the water network in the province of Zeeland.

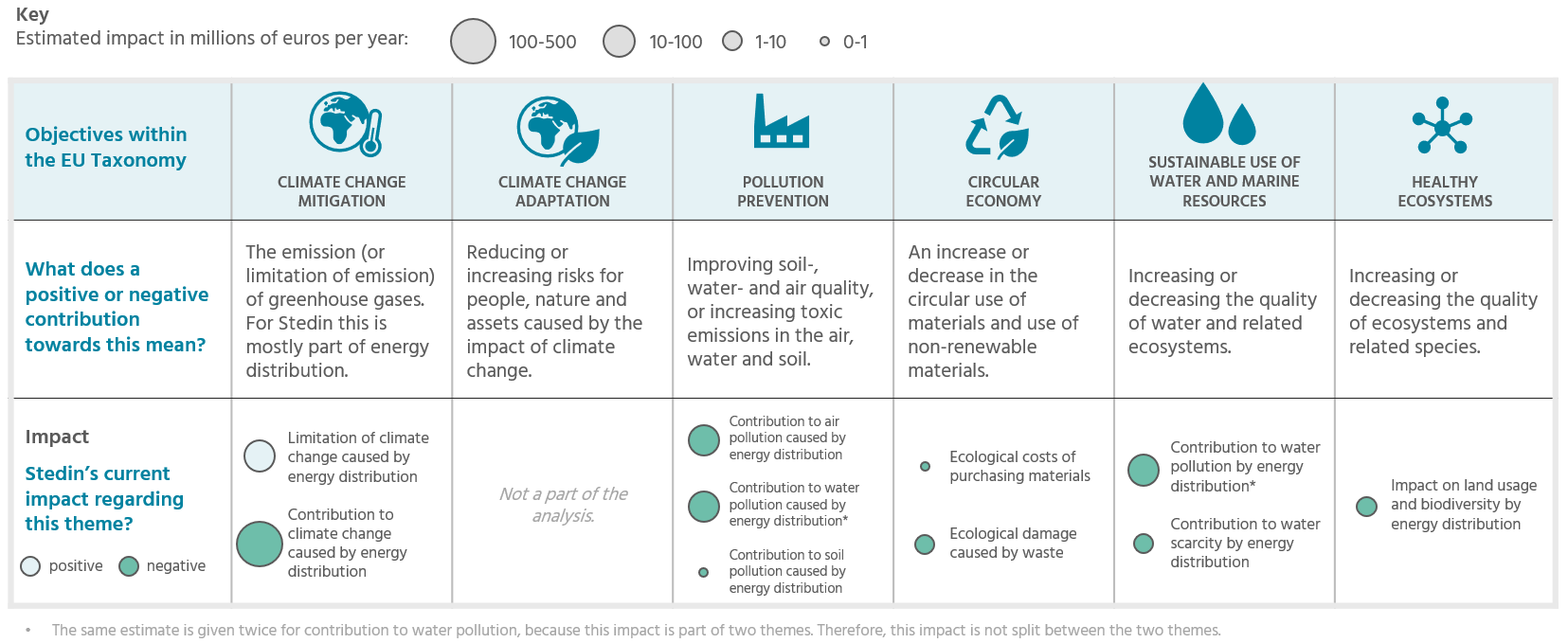

The EU Taxonomy establishes six environmental objectives. In 2021, the descriptions of the sustainable economic activities classified by the European Union were only elaborated for two of the six environmental objectives: climate change mitigation and climate change adaptation. The EU is expected to elaborate the remaining four objectives in 2022. Stedin must meet these objectives for financial year 2022. Specifically, they relate to the sustainable use and protection of water and marine resources, the transition to a circular economy, pollution prevention and control and the protection and restoration of biodiversity and ecosystems. Subsequent to the introduction of the remaining four objectives, the following provisions will be important for determining whether an economic activity can be classified as sustainable: 1. contributes substantially to one or more of the six environmental objectives, including the transition to a circular economy; 2 does no significant harm to one of the remaining five environmental objectives; 3 meets the minimum social safeguards.

The figure below shows an estimate of Stedin’s net impact on the themes in the EU Taxonomy. In addition to direct impact due to ecological damage from the procurement of goods and waste, the impacts shown concern the climate and environmental impacts due to our role in the energy supply chain. The main way in which we can reduce the presently still negative impacts is by facilitating the energy transition. Greening the energy mix will lead to a significant reduction in the contribution to climate change, air pollution and water pollution. An analysis of the climate themes in the EU Taxonomy shows that 61% of our investments in 2021 qualify as eligible (see the table on the previous page). In addition to our supply chain responsibility, we have direct impact from our own operations. How we are working on reducing our own climate and environmental impact is explained in the sections 'Positive impact on people and the environment' and 'Measuring impact'.