Financial and economic performance

Stedin Group has a public task. We treat our social capital prudently and intelligently. A financially healthy Stedin Group has the necessary strength to facilitate the acceleration of the energy transition

To enable the accelaration of the energy transition and the electrification of the energy grid, facilitate economic grwoth and ensure the quality of the current grid, Stedin invested over € 700 million in its electricity and gas grids in 2022. Between 2023 and 2030, we will invest at least a further €8 billion. We will therefore have to scale this up to an average level of €1 billion a year. Additional ambitions such as Fit For 55, RePowerEU or fees for congestion management may further increase this amount.

Using opportunities

A lot of money will be needed to make these investments. Stedin is using all possibilities at its disposal to strengthen its financial position:

Efficient working: Stedin continues to take a critical view of its own costs. We have an efficiency programme in place until year-end 2025 that aims to achieve long-term cost savings of €180 million. Read more about the objectives, results and follow-up of this efficiency programme in the ‘Affordable and efficient services’ section.

Effective investment: Stedin is fully committed to risk-based maintenance. We carefully consider the investments needed to keep the grid safe.

Strengthening our equity: Our shareholders made an initial capital contribution of €200 million to strengthen our equity in the short term in 2021. In addition, most of the previous gain of €251 million on the sale of the non-regulated entity Joulz has also remained within the company.

Meeting the capital requirement

To be able to invest €8 billion in the energy infrastructure between now and 2030, we need €1.8 billion in additional equity as well as loans and our own tariff revenue. This requires a contribution from various parties. Close consultation with a large number of stakeholders on meeting this capital requirement was therefore a recurrent feature in 2022. This led to the central government reserving €500 million in its budget for strengthening Stedin Group’s equity, as it announced on Budget Day. The latter months of the year featured the further development of this participation. We were closely involved with the grid managers Enexis and Alliander here, as they also may need to make an appeal to the central government in the future. Our 44 shareholders also played an important part in this process.

The government and the grid companies Alliander, Enexis and Stedin reached a joint agreement at the end of 2022 regarding the conditions under which a capital contribution could be made by the government in the grid companies and thus become a shareholder. The conditions have been laid down in an agreements framework. This will serve as the basis for a potential participation agreement in which more detailed agreements will be established. The agreements framework is currently before the Supervisory Boards, employee representative organisations and existing shareholders of the grid managers for consideration. Stedin has already made a request for a capital contribution of € 500 million under the agreements framework. The Ministry of Economic Affairs and Climate Policy set aside this amount of €500 in its budget for 2022. The exact conditions for this financial support will be further developed in 2023 between Stedin, the Ministries of Economic Affairs and Climate Policy and Finance and the shareholders of Stedin.

In addition, Stedin and the shareholders committee will consult with municipalities and provinces to consider how they can also contribute as (new) shareholders. In the summer, Stedin invited local and regional authorities in its service area to participate in Stedin. More detailed information was then provided and several information meetings were held. Discussions on possible participation in a shareholding are still ongoing. We hope to have a better idea of the outcomes in the third quarter of 2023.

Regulation

In addition to these solutions, Stedin continues to argue for changes to the regulatory model. The method decision published by the ACM in 2021 sets out how the grid managers’ tariffs will be calculated until the end of 2026. For grid managers, it is essential that this enables sufficient funds to be generated for them to (pre)finance the energy transition. As costs precede revenues for the grid managers when undertaking investments, this presents a financing challenge. The grid managers urged that the current regulatory model needs to be adjusted, since at this moment it is not sufficiently in line with the tasks facing the grid managers in facilitating the energy transition. We continue to consult with the ACM on this issue. One result has been that a part of the network losses, the costs for loss of electricity due to factors such as transmission and theft, will be compensated earlier. Network losses increased substantially last year due to the rise in energy prices. More information on network losses is presented in the ‘Financial results’ and ‘Risk management’ sections.

Loan capital - green bond

Stedin Group successfully issued a €500 million green bond in May 2022. This capital will be invested in the expansion and reinforcement of the electricity grid that will be used for the connection of new wind and solar parks and improving the sustainability of our business operation, as well as for the repayment of a €300 million bond issued in 2017. Green bonds have already been issued in 2019 and 2021. Stedin Group has now issued €1.5 billion in green bonds, and published a new green bond report on this in December 2022. The loan of €500 million has a term of 8 years, an issue price of 99.318% and a coupon interest of 2.375% (effective interest rate of 2.47%). Stedin Group attracted both existing and new sustainable investors through this bond issue, which was oversubscribed almost twice. This was partly thanks to the excellent terms under which the bond was issued. The bond is listed on Euronext Amsterdam. More information on the Green Finance Framework and the green bond Reports is available on our website.

ISS ESG has given Stedin as a business a general sustainability rating of B. With this rating and the high rating of its level of transparency on non-financial information, Stedin has been awarded Prime status.

Credit rating

Standard & Poor’s (S&P) has reaffirmed Stedin Group’s A- credit rating with a stable outlook in a sector report published on 25 July 2022. This states that S&P has confidence in the government’s readiness to support the credit ratings of the regional grid managers. S&P is of the opinion that government support helps to create space in the credit ratios of the three Dutch regional grid managers, where Stedin has the least financial room. The report also states that the rating would come under pressure if there are delays in the provision of government support or if no further support is forthcoming from the current and/or potential new shareholders of Stedin. In its report, S&P states that it would like to see evidence of upcoming support from the government and/or new or existing shareholders by the end of 2022.

For the latest developments regarding the credit rating, see note 34 Subsequent events.

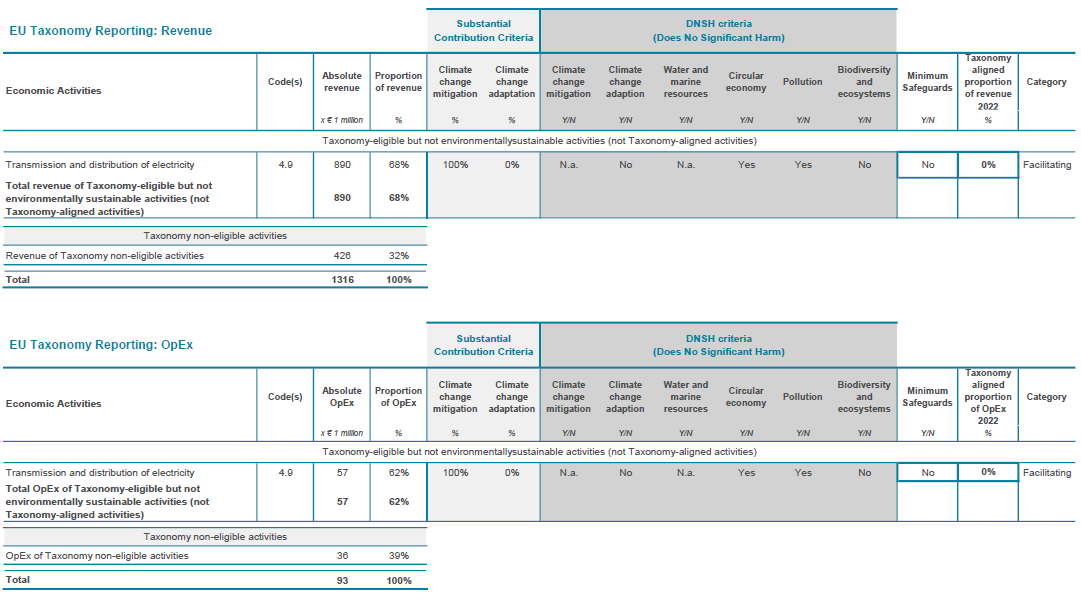

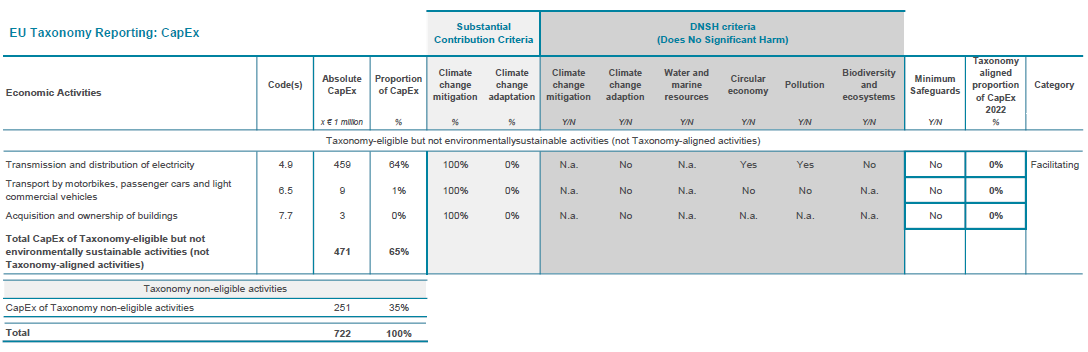

EU Taxonomy

The EU Taxonomy is part of the European Union’s Green Deal, which aims to ensure that Europe will be a climate-neutral continent by 2050. The taxonomy is a guideline for investments in sustainability and clarifies which of our activities may be qualified as ecologically sustainable. In 2021, as a public interest entity, we reported for the first time on the sustainable part of our revenue, capital expenditure (CapEx) and operating expenditure (OpEx), known as ‘taxonomy-eligible’ economic activities. In 2022, we took the next step in our reporting and assessed whether the taxonomy-eligible activities qualify for ‘alignment’. This means that we assessed whether the taxonomy-eligible economic activities, according to the technical screening criteria established by the EU for the first two environmental objectives (climate mitigation and climate adaptation) contribute and do no harm to the other environmental objectives:

climate mitigation;

climate adaptation;

sustainable use and protection of water and marine resources;

the transition to a circular economy;

the prevention and combating of pollution;

the protection and recovery of biodiversity and ecosystems.

The technical screening criteria will be periodically revised to align with the trajectory towards achieving the Paris Agreement.

In addition, it must be shown that minimum social safeguards are met; a company’s procedures and processes must be in accordance with the guidelines of the Organisation for Economic Cooperation and Development (OECD) and guiding principles from the UN on industry and human rights.

If the taxonomy-eligible economic activities meet the technical screening criteria and do no harm to the aforementioned environmental objectives and the minimum social safeguards are met, they are ‘taxonomy-aligned’.

Taxonomy-eligible activities

Stedin contributes to sustainability with the following economic activities:

4.9 Transmission and distribution of electricity (this principal activity of Stedin falls under NACE code 35.13 ‘Distribution of electricity’);

6.5 Transport with motorcycles, passenger cars and light commercial vehicles; and,

7.7 Acquisition and ownership of buildings.

The taxonomy also covers non-sustainable economic activities, known as ‘taxonomy non-eligible’ economic activities. For Stedin, this concerns NACE code 35.22 ‘Distribution of gaseous fuels through mains’.

For the above taxonomy-eligible activities, we have subsequently assessed whether these contribute to and do no harm to the six stated environmental objectives:

Climate change mitigation

Stedin’s electricity grid is, as established in the Electricity Act 1998, connected to the European energy system and therefore meets one important screening criterion. Increasingly large amounts of sustainably generated electricity are transported on our electricity grid, and this activity thus complies with the principle of the taxonomy. The application of electric transport (for both passenger cars and commercial vehicles) has a positive impact. More than two-thirds of our newly purchased or replaced commercial vehicles emitted less than 50 g CO2/km in 2022, and thus complied with the screening criteria. Lastly, we are seeing the positive effects of improving the sustainability of our buildings. Our three main premises (at Delft, Utrecht and Goes) have energy performance ratings of A or A++ and thus meet the screening criteria. The economic activities classified as eligible (4.9, 6.5 and 7.7) contribute to climate mitigation.

Climate change adaptation

Stedin has identified the climate changes that are most likely to affect its activities and have a material impact on its service area. These are the risk of flooding, and the impact of climate development on our grid. For instance, we are running a pilot project using heat sensors to establish the impact of heat stress on our assets above ground. In addition, Stedin is working with the other grid managers in Netbeheer Nederland on climate-related issues. We are also involved in the Delta Decree on Spatial Adaptation, which obliges managers of vital infrastructure to study the effects of water damage and flooding on the functioning of that infrastructure and take appropriate measures where necessary. Despite these important steps, we have concluded that we do not yet meet all the taxonomy criteria. In 2023, Stedin will devote itself to fully setting up its climate adaptation policy and taking action on the criteria it has not yet met, such as by performing of a comprehensive climate risk analysis and drawing up a climate adaptation plan. More information on this is presented under ‘Risks for Stedin due to climate change and adaptation’ in the ‘Impact on people and planet’ section.

Sustainable use and protection of water and marine resources

No criteria for this environmental objective have yet been published.

Transition to a circular economy

Together with our waste management partners, Stedin strives to achieve maximum reuse or recycling of assets and materials at the end of their useful lives in accordance with the waste hierarchy. This has been established contractually, meaning that we meet an important screening criterion. We are consulting with our suppliers to establish whether the passenger cars and commercial vehicles we use meet the requirements of this environmental objective. We do not have all the information necessary to report on this at this time. Read more about this in the ‘Impact on people and planet’ section.

Prevention and combating pollution

Stedin follows the principles of the IFC General Environmental, Health and Safety Guidelines and does not use polychlorinated biphenyls (PCBs) as prohibited under EEC Directive 85/467/EEC since 1985. We thus meet an important screening criterion. Here too, we depend on information from our suppliers to establish whether we contribute to this environmental objective. We are consulting about this with our suppliers, but we have not yet obtained the information we need to report on this at this time.

Protection and recovery of biodiversity and ecosystems

Stedin is consulting about this with municipalities, provinces, water boards and local residents, and has started work on repairing biodiversity at five large stations. This involves the installation of green roofs and/or planting at and around our transmission and distribution stations. Stedin works in accordance with the Nature Conservation Act (Wet natuurbescherming) and implements the required limiting and countervailing measures for an environmental effect assessment or screening. This is a permanent feature in our project approach. In addition, in anticipation of the implementation of the Environment and Planning Act (Omgevingswet), an infographic ‘Nitrogen deposition in investment projects’, a toolbox ‘Nitrogen deposition and Natura2000 areas at connections’ and an instruction ‘Natura 2000 Environmental Scan’ have been implemented. These tools show the steps that need to be taken to design a route that takes account of the potential negative effects of our activities on plants, animals and habitats. The impact of nitrogen also plays a role. When essential works have to be carried out in a Natura2000 area, a quick scan or ecological study will be requested. The ecologist’s findings have to be included in the design and execution at all times. Despite the many steps in the right direction, we do not yet meet all the taxonomy criteria. We will focus on completing all the details in 2023, including the implementation of our revised sustainability strategy. You can read more about biodiversity in the ‘Impact on people and planet’ section.

Minimum safeguards

Stedin applies the Dutch Corporate Governance Code. In addition, several steps have been taken to comply with the social minimum safeguards for all four of the ethical themes (human rights, bribery and corruption, tax and fair competition). We have had a potential risk analysis made of our supply chain and formulated an action plan in line with the Corporate Sustainability Due Diligence Directive (CSDDD) based on the six-step plan inspired by the OECD. We will produce quarterly reports on this in 2023. We have also taken measures to prevent risks and harmful (internal) effects on these themes with our confidential counsellors, whistle-blower scheme, code of conduct and procurement policy. Read more about this in the ‘Governance’ section. Finally, we have implemented appropriate processes to ensure that relevant legislation and guidelines with respect to bribery and corruption, tax and fair competition are complied with and we have achieved ISO 27001 certification (on information security). Despite all these important steps, we do not yet meet all the criteria for these minimum safeguards as for example, we do not have an overarching policy.

Where are we now

Stedin has made significant progress on achieving its sustainability goals in recent years. Based on a thorough assessment of the EU Taxonomy, however, our conclusion is that we do not yet fully meet the criteria set for the ‘Climate adaptation’ and ‘Biodiversity and ecosystems’ environmental objectives and the minimum social safeguards. Due to the binary nature of the EU Taxonomy (a company is aligned or it is not aligned), we accordingly report eligible revenue, CapEx and OpEx in 2022 but no alignment in these categories.

This is shown in table form, divided into revenue, CapEx and OpEx, below:

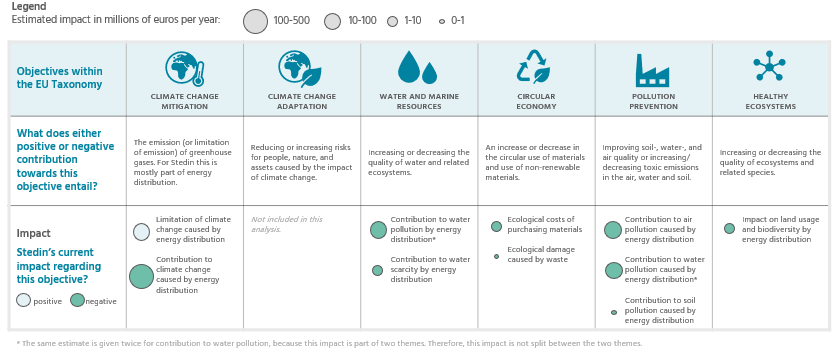

Net impact on the six EU climate objectives

Stedin aims to be a climate-neutral, circular, diverse and inclusive organisation in 2030. We also aim to increase our positive impact on the environmental objectives and reduce the negative impact of our business operation as far as possible. The figure below shows an estimate of Stedin’s net impact on the themes as formulated in the EU Taxonomy. In addition to the direct impact due to ecological damage from the procurement of goods and waste, there is also an impact due to our role in the energy supply chain. The main way in which we can reduce the presently still negative impact is by further facilitating the energy transition.

Greening the energy mix will lead to a significant reduction in the contribution to climate change, air pollution and water pollution. The EU climate objectives focus mainly on the assessment and reporting of the impact on what is known as the ‘natural capital’. Stedin’s impact on all capital types as stated in the value creation model is described in the ‘Measuring impact’ section. How we are increasing our positive impact and actively reducing our negative impact is explained in the ‘Impact on people and planet’ section.

Accounting principles

Revenue

Total revenue under the EU Taxonomy is consistent with IFRS reporting standards and is thus equal to the total (net) revenue as presented in the consolidated income statement. The proportion of total revenue that is earned from taxonomy-eligible activities is determined by assessing for each revenue-generating activity to what extent this activity is mentioned in the EU Taxonomy.

Capital expenditure (CapEx)

Total capital expenditure under the EU Taxonomy concerns the investments in property, plant and equipment (see ‘Property, plant and equipment’), as well as property, plant and equipment obtained through acquisitions (if applicable), investments in intangible assets (see ‘Intangible assets’) and additions to the right-of-use asset (IFRS 16) (see ‘Leases’). The proportion of total capital expenditure that is related to taxonomy-eligible activities is determined by identifying the economic activity associated with each asset group and assessing to what extent this activity is mentioned in the EU Taxonomy,

Operating expenditure (OpEx)

Operating expenditure under the EU Taxonomy is defined as direct non-capitalised costs that relate to the maintenance of our assets. Based on this definition, Stedin has only classified expenditures relating to maintenance and failures as operating expenditure under the EU Taxonomy. The proportion of these maintenance and failure costs that relates to taxonomy-eligible activities has been determined.

The descriptions of the identified eligible activities (4.9, 6.5 and 7.7) do not contain any overlap. There is therefore no risk of double-counting in the determining the numerators for the three KPIs (revenue, CapEx and OpEx).