Most important risks and opportunities for Stedin Group in 2020

This section describes the most important risks and opportunities for Stedin Group. For information about our financial reporting risks, see Judgements, estimates and assumptions as well as Management of financial risks in the Financial Statements.

Connection of risks and opportunities to strategic spearheads and material topics

Strategic spearheads | Change | |||||

|---|---|---|---|---|---|---|

Risk | Category | Material topics |

|

|

| |

1 Cyberattack | Operational | Data security, privacy and cybersecurity – Supply security – Reputation | ● | ● | ||

2 Unavailability of enough people with the required technical competences | Operational | Sufficient technical/IT staff – Training and development | ● | ● | ||

3 IT landscape insufficiently prepared for the future | Strategic | Smart grids, data technology and innovation | ● | ● | ||

4 Agility of the organisation | Strategic | Organisation's capacity for change – Reputation | ● | ● | ● | |

5 Uncertainties concerning changes in laws and regulations | Compliance | Stakeholder dialogue and environment | ● | |||

6 Uncertainties concerning long-term financing | Financial | Economic, financial performance – Investing in infrastructure | ● | ● | ||

7 Impact of accidents | Safety | Safety at work and in the environment – Reputation | ● | |||

8 Insufficient connection and transmission capacity | Strategic | Investing in infrastructure – Contributing to the energy transition – Customer satisfaction – Stakeholder dialogue and environment | ● | ● | ● | |

9 Loss of communication network | Operational | Contributing to the energy transition – Reputation | ● | ● | ||

10 Increased likelihood of surge to replace obsolete assets | Strategic | Economic, financial performance – Investing in infrastructure – Supply security | ● | ● | ● | |

Opportunity | ||||||

1 Strategic supplier relationships | Stakeholder dialogue and environment – Social responsibility in the supply chain | ● | ● | |||

2 Disruptive technologies and methods | Smart grids, data technology and innovation | ● | ||||

3 Provide stakeholders and customers with more self-services | Contributing to the energy transition – Reputation – Customer satisfaction – Stakeholder dialogue and environment | ● | ● | |||

4 Building a future-proof IT landscape | Smart grids, data technology and innovation – Data security, privacy and cybersecurity | ● | ● | |||

+ New in 2020 / = Equal to 2019 / ↑ Increased relative to 2019 / ↓ Decreased relative to 2019

Categories of strategic risks and opportunities

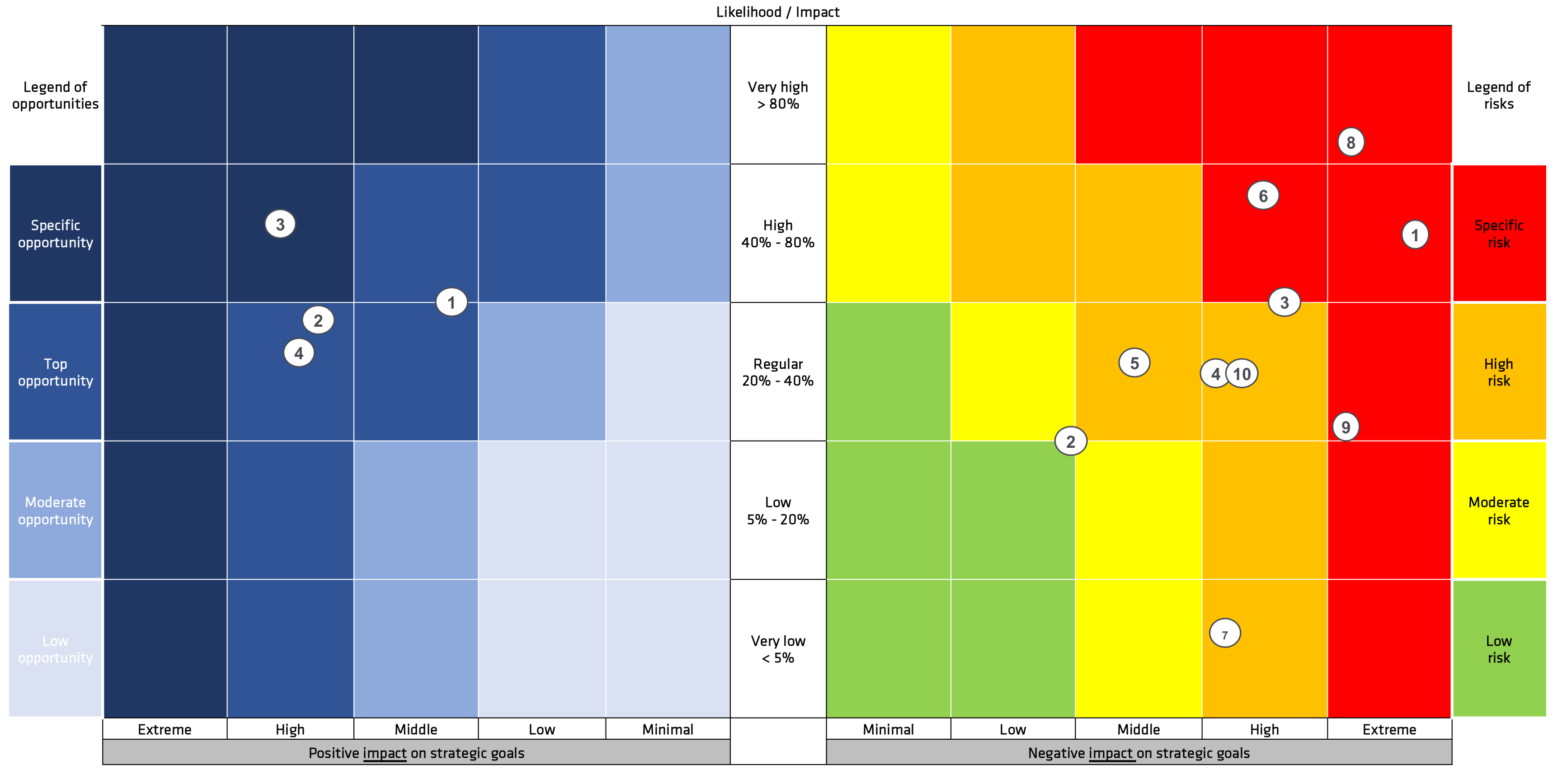

Stedin Group assigns its strategic risks and opportunities to five categories, from low to top. In evaluating risks and opportunities, we compare the likelihood of their occurrence with their potential impact on the achievement of our three strategic spearheads. This comparison led to the risk matrix below for 2020.

Strategic opportunities:

1Strategic supplier relationships

2Disruptive technologies and methods

3Provide stakeholders and customers with more self-services

4Building a future-proof IT landscape

Strategic risks:

1Cyberattack

2Unavailability of enough people with the required technical competences

3IT landscape insufficiently prepared for the future

4Agility of the organisation

5Uncertainties concerning changes in laws and regulations

6Uncertainties concerning long-term financing

7Impact of accidents

8Insufficient connection and transmission capacity

9Loss of communication network

10Increased probability of wave of replacements of absolate assets.

Risks

Title of risk: | 1 Cyberattack |

|---|---|

Description of risk | As a result of its strategic location as well as its social and economic importance, the Stedin Group infrastructure is an attractive target for cyberattacks. A cyberattack can endanger the continuity of Stedin Group and society. |

Risk tolerance | Avoiding |

Change from 2019 | ↑ |

Risk assessment | Top |

How did we respond to this fact in 2020 | Cybersecurity has been more strongly embedded in the business processes. The commitment to security throughout Stedin was boosted further in 2020 by the implementation of the ISO27001 standard. |

Title of risk: | 2 Unavailability of enough people with the required technical competences |

|---|---|

Description of risk | Due to ageing and tightness in the labour market, there is a risk that we will no longer have enough staff with the required technical or other competences. |

Risk tolerance | Avoiding |

Change from 2019 | ↓ |

Risk assessment | Moderate |

How did we respond to this fact in 2020 | We have increased our insight into and grip on inflow, internal advancement and outflow. A Strategic Personnel Plan for the operational departments is in place, and we are building on a successfully launched labour market campaign. This is supported by the courses of our in-house training school and the newly established mobility desk. Using these instruments, we have reduced this risk to the desired level. |

Title of risk: | 3 IT landscape insufficiently prepared for the future |

|---|---|

Description of risk | Stedin Group needs an integral IT infrastructure in order to support the future primary processes and facilitate the energy transition. |

Risk tolerance | Neutral |

Change from 2019 | ↓ |

Risk assessment | High |

How did we respond to this fact in 2020 | Effective steps are being taken within Stedin to ensure that the IT landscape is more adequate for the future. In the HICC project, a large part of the business applications was moved to the cloud. In addition, the key starting principles for a future-proof IT landscape were substantiated, and recommendations were made for a system-based approach. Moreover, the revised organisation of vendor management enables us to better anticipate market developments. |

Title of risk: | 4 Agility of the organisation |

|---|---|

Description of risk | The culture and conduct of Stedin Group must change in accordance with the changes in the energy landscape so as to fulfil its role in the energy transition. |

Risk tolerance | Neutral |

Change from 2019 | = |

Risk assessment | High |

How did we respond to this fact in 2020 | This year, our leadership profile was augmented with a description of the type of conduct we need in order to realise Stedin's vision & strategy. We will be utilising this profile as a guideline in the coming period to further advance the development of leaders & teams. A clear ambition has been formulated. We also know where we stand at present and what we need to do to advance our development. |

+ New in 2020 / = Equal to 2019 / ↑ Increased relative to 2019 / ↓ Decreased relative to 2019

Title of risk: | 5 Uncertainties concerning changes in laws and regulations |

|---|---|

Description of risk | National or European governments may take undesirable decisions on the role of regional grid managers. This situation can lead to uncertainty about the implementation of our strategy. |

Risk tolerance | Averse |

Change from 2019 | = |

Risk assessment | High |

How did we respond to this fact in 2020 | Stedin Group closely follows developments in Europe and The Hague, and it is represented in the national lobby, preferably through the industry association Netbeheer Nederland. Our Regulation department participates in the European lobby. Stedin Group is aware of amendments to existing laws and new laws well in advance. The delay in developing/updating Energy Act 1.0 is an aspect that requires attention. This may lead to sub-optimal regulations, temporarily or otherwise, to implement necessary changes sooner. |

Title of risk: | 6 Uncertainties concerning long-term financing |

|---|---|

Description of risk | A regulation model that is not aligned with the financial challenges of the grid managers in the energy transition entails a risk of further cost increases that outpace increases in regulated revenue. This can endanger the availability of financing. |

Risk tolerance | Avoiding |

Change from 2019 | ↑ |

Risk assessment | Top |

How did we respond to this fact in 2020 | The present regulatory model is not aligned with the task and the financial challenges of the grid managers in the energy transition. As the increase in investments outpaces increases in regulated revenue, a capital requirement arises and Stedin's financial position comes under pressure. Investments in our grids with a view to ensuring good grid management and realising the energy transition lead to a capital requirement of €750 million to €1 billion. Additionally, it became clear in 2020 that the WACC, as set by the Netherlands Authority for Consumers and Markets, will decrease further in the new regulation period. This will result in a considerable decrease in income for grid managers. To ensure that we can undertake the required investments, we need to critically assess our own costs and respond to the developments of financial markets as well as laws and regulations. The talks with various stakeholders to strengthen equity were continued in 2020. Talks were also conducted with the Netherlands Authority for Consumers and Markets on adjustments to the regulatory model. These will also be continued in 2021. |

Title of risk: | 7 Impact of accidents |

|---|---|

Description of risk | Due to insufficient safety awareness and learning ability, there is a risk of unsafe situations. As a consequence, Stedin Group could suffer reputational damage and be subject to sanctions imposed by regulators. |

Risk tolerance | Averse |

Change from 2019 | = |

Risk assessment | High |

How did we respond to this fact in 2020 | Our multi-year safety programme is based on the principles of the High Reliability Organisation (HRO). We completed phase 1 ‘Raising awareness’ in 2018 and phase 2 ‘Updating knowledge’ in 2020. We have now started on phase 3, ‘Embedding routines’. The entire Stedin Netbeheer organisation obtained certification for level 4 of the Safety Culture Ladder in 2020. Work is under way within DNWG in 2021 on certification for level 3 of the Safety Culture Ladder as a stepping stone to level 4 in 2022. For NetVerder, we are examining how we can apply the Safety Culture Ladder for that type of organisation. |

+ New in 2020 / = Equal to 2019 / ↑ Increased relative to 2019 / ↓ Decreased relative to 2019

Title of risk: | 8 Insufficient connection and transmission capacity |

|---|---|

Description of risk | If we fail to reinforce our grids soon enough, it is possible that we may not be able to provide transmission capacity for our customers. In that situation, we will be unable to comply with customers' requirements, customers will have to cancel their projects and this situation will delay the achievement of the climate objectives. |

Risk tolerance | Neutral |

Change from 2019 | = |

Risk assessment | Top |

How did we respond to this fact in 2020 | Stedin is party to all relevant Regional Energy Strategies and National Charging Infrastructures. We also map customer demand to a far greater extent, so that our customers know where capacity is available and where potential bottlenecks might arise in the grid. In addition, we have adopted a more proactive investment approach and have drawn up ‘Master Plans’ that provide insight into the infrastructure that is necessary to achieve the objectives by 2050. It has become clear for Enduris that we are probably too late for one region, and we therefore had to issue an advance warning of structural congestion in the municipalities of Schouwen-Duiveland and Tholen. |

Title of risk: | 9 Loss of communication network |

|---|---|

Description of risk | Due to uncertainties concerning the long-term availability of our communication networks (GPRS and CDMA), there is a risk that we will be unable to read out information from the smart meters or will have to incur more costs for permanent access or alternative technology. |

Risk tolerance | Avoiding |

Change from 2019 | = |

Risk assessment | Top |

How did we respond to this fact in 2020 | In 2020, investments were made in the CDMA network that allow its useful life to be extended to 2034. Stedin is also in talks with the Ministry of Economic Affairs and Climate Policy on the form of the auction for the licence for the use of the CDMA network as from 2025. Negotiations with telecom providers on the use of the GPRS network are continuing, in cooperation with other grid managers. |

Title of risk: | 10 Increased likelihood of surge to replace obsolete assets |

|---|---|

Description of risk | With the current policy, we see a greater likelihood of a surge to replace assets due to their growing obsolescence. Preparing for a possible surge of replacements entails uncertainty because the amount and timing are difficult to predict. |

Risk tolerance | Neutral |

Change from 2019 | + |

Risk assessment | High |

How did we respond to this fact in 2020 | On the one hand, we have further improved and strengthened the risk-based maintenance on the basis of failure curves. On the other, we schedule replacements by using and combining many more data sources. This has enabled us to increase the effectiveness of maintenance and replacements. Both the risk-based maintenance and scheduling of replacements are carried out on the basis of machine learning and advanced analytics. |

+ New in 2020 / = Equal to 2019 / ↑ Increased relative to 2019 / ↓ Decreased relative to 2019

Opportunities:

Title of opportunity: | 1 Strategic supplier relationships |

|---|---|

Description of opportunity | Strategic relationships with suppliers increase our responsiveness and improve our cost-effectiveness. |

Change from 2019 | ↑ |

Opportunity assessment | High |

How did we respond to this fact in 2020 | We have established a Strategic Vendor Board in which we implement the collaboration with new and existing suppliers and carry out the programme management for our tendering procedures. The creation of the new supply chain organisation in May 2020 aims to properly tailor supply to requirements/demand. By reciprocally sharing long-term objectives and requirements with our strategic suppliers, we can collaborate more effectively and efficiently and achieve shared objectives. |

Title of opportunity: | 2 Disruptive technologies and methods |

|---|---|

Description of opportunity | We see an opportunity to apply new methods, technologies and new ways of collaborating and to utilise data effectively. This enables us to better carry out our task within the energy system, increase our capacity for innovation, work more efficiently and facilitate the energy transition. |

Change from 2019 | = |

Opportunity assessment | High |

How did we respond to this fact in 2020 | In 2020, the ambition for hydrogen in the natural gas grid became tangible, with the project Stad aan ’t Haringvliet op Waterstof in 2025 (Town at ’t Haringvliet on Hydrogen by 2025). There are also specific experiments in the area of reducing peak load in flats that are switching to induction cooking, and pilot studies are under way for facilitating decentralised generation and exchange of electricity. Also, Opening Bid 1.0 was launched to make the heat transition transparent and manageable. Lastly, results were achieved on innovating existing business processes, such as using automation on financial approval processes and gas business operations. |

Title of opportunity: | 3 Provide stakeholders and customers with more self-services |

|---|---|

Description of opportunity | By assisting stakeholders and customers, and by giving them control, we enable them to improve the sustainability of the energy system while minimising societal costs. |

Change from 2019 | = |

Opportunity assessment | Top |

How did we respond to this fact in 2020 | By developing products and services in fields such as heat transition, electrical mobility and generation, we give customers insight into the possibilities on our grid, on the basis of which they can make choices in the energy transition. We create insight into what our environment is asking of us in the long term, so that we can invest effectively and are engaged proactively in dialogue with customers on opportunities and limitations in the energy infrastructure. |

+ New in 2020 / = Equal to 2019 / ↑ Increased relative to 2019 / ↓ Decreased relative to 2019

Title of opportunity: | 4 Building a future-proof IT landscape |

|---|---|

Description of opportunity | Stedin Group is increasingly becoming a data and IT-driven organisation. By building a future-proof IT landscape, we are increasing our flexibility and our innovative potential. |

Change from 2019 | = |

Opportunity assessment How did we respond to this fact in 2020 | Top In order to increase Stedin's flexibility, agility and capacity for innovation, we need to link process architecture and technology to the greatest possible extent. The combination of the HICC project, the expansion of the API management, the de-customisation of SAP and the advancement of digitalisation initiatives will help Stedin to capitalise on this opportunity. |

+ New in 2020 / = Equal to 2019 / ↑ Increased relative to 2019 / ↓ Decreased relative to 2019